SkySlope Books supports 1099 reporting for 1099 NEC, MISC, and INT.

In this article, we will cover:

- Types of 1099 reporting

- Creating/Updating tax records for a Contact

- Accessing and Creating 1099 Reports

- Editing 1099 Reports

Important Details

Please review these details before you proceed.

- All 1099 reports provided by SkySlope Books should be verified for accuracy before they are submitted to the IRS.

- At this time, SkySlope Books will provide 1099s as a printable PDF. SkySlope Books does not submit the 1099 to the IRS.

- The information provided in this article is not legal advice. If you have questions regarding the type of 1099 to provide or any other tax-related questions, please consult an accountant.

- For more information about 1099 forms, please review the Instructions for 1099 Forms (provided by the IRS).

Types of 1099 Reporting

- 1099-NEC: This 1099 is used for agents who are contractors, but not employees, of the brokerage.

- 1099-MISC: This 1099 is used to record miscellaneous income, such as rental payments made to the brokerage.

- 1099-INT: This 1099 is used for interest earned on savings, and would need to be provided to clients who have earned interest on escrow deposits.

Step One: Creating/Updating Tax Records for a Contact

IMPORTANT: In order to create a 1099 report for a user, you must first ensure the required fields have been added to the contact in SkySlope Books. Follow the instructions below to provide the required information prior to printing out the tax record.

- In the left menu, navigate to the Directory, and then to the Contacts page.

- Locate and click on the contact for whom you want to add the tax record.

- Then, click the pencil icon to edit the contact.

- Navigate to the Payroll tab.

- Under 1099, click Add Tax Record.

- A pop-up window will appear containing the following required fields:

- Name of Recipient: Enter the full name that should appear on the 1099.

- Start Date: Enter the date that the contact worked for you, or the date which the contact got paid via a corporation rather than as an individual.

- Tax Type: This is the type of Tax ID you want to associate with the 1099.

- Tax SSN/EIN: Enter the SSN or EIN number for the contact.

- Address: Add the address

- Click Add

Step Two: Creating 1099 Reports

- In the left menu, navigate to the Reporting section, and then to the Detailed Reports page.

- Click Create Report in the upper right corner.

- Then, under the Company Level, click on Financial Reports.

- In the list of reports on the right, you will find all three 1099 reports: 1099-NEC, 1099-INT and 1099-MISC.

-

- You can hover your mouse over the info icon to learn more about each report.

-

- Click to select the type of report you want to create.

- After selecting the type of report, you will have to fill in some parameters for the report:

- Time Period: Select the time period for data you'd like to include in the report.

-

Entity: You must select at least one group of contacts for the report to generate.

- Click in the Participants line.

- Groups and contacts will be listed alphabetically.

- Either type the name of the group or contact, or scroll through the list and select.

- After selecting, click on the line again if additional groups or contacts need to be added.

- Form Pages: Select which pages you would like to view in the report.

- PDF Generation: This is an option that the PDF will show Such as Count Contacts and whether TIN data should be hidden or not.

- Click Save and Run Report.

- Name the report and select a category (if applicable).

- Click Save.

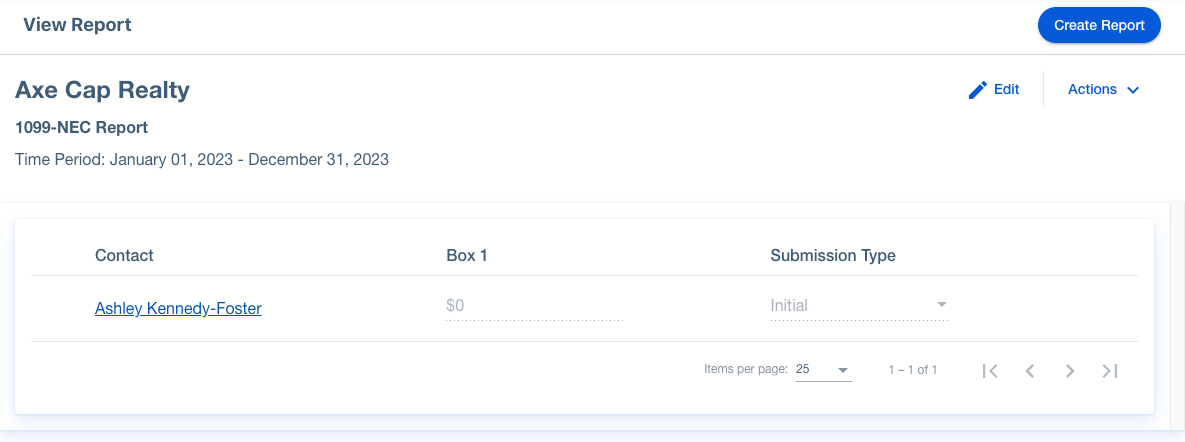

- After saving the report, you will land on this page:

-

To print as PDF:

- Click Actions in the top right.

- Select Print PDF from the dropdown.

- Once complete, the report will be available to view and download from the bell icon in the top right.

Step Three: Editing 1099 Reports

Prior to downloading the report, the 1099 report can be edited to add missing tax records, modify the compensation amount for a contact, or modify the type of 1099.

Creating Tax Records from Report

- After running the report, the View Report page will be displayed.

- You can now view some details regarding the 1099 data.

- If there are any contacts that were included in the report for which SkySlope Books does not have tax records, they will be listed first. The red info icon to the left of their name indicates “missing tax record details.”

- Tax records for these contacts will need to be created.

- Click on the name of the contact.

- The Create 1099 Tax Record pop-up will appear.

- Here you can put tax details similar to the steps in the section above for creating tax records.

- Complete the fields and Save.

Modifying the Type of 1099 Report

The type of report you want to print out can be updated as you send out different versions of the report.

-

In the Submission Type field, click on the dropdown for the line item you want to modify.

-

There are three options:

- Initial (default)

- This is the first 1099 filed on behalf of the contact.

- Void

- This is used when you are voiding a previous 1099 filed.

- Correct

- This is used when you are providing a corrected 1099 that was previously filed incorrectly.

- Initial (default)

Modifying Compensation Numbers from Report

In the Box 1 field, the non-employee compensation amount will be displayed. This is the total payouts made to the contact for the agent split amount. If you need to adjust this amount, please refer to this resource: Editing the 1099 NEC Report.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article